Insights + interviews

Pension Index 2014 Ranks Singapore

Singapore’s retirement system continues to rank #1 amongst Asian countries but adequacy remains the primary shortcoming.

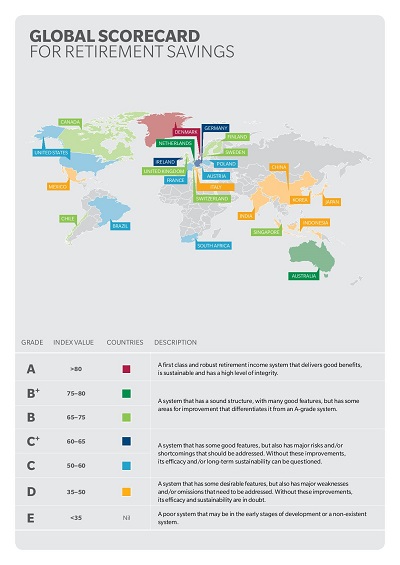

Singapore continues to score a grade of ‘B’ on the Mercer Melbourne Global Pension Index for 2014, which described Singapore’s system as a sound structure, with many good features, but has some areas for improvement that differentiates it from an A-grade system. Adequacy however, remains the main shortcoming of the Singapore system.

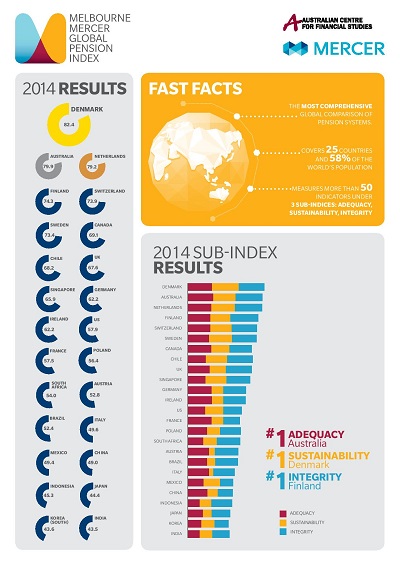

The MMGPI measured 25 retirement income systems against more than 50 indicators under the sub-indices of adequacy, sustainability and integrity. Singapore ranked #1 amongst Asian countries and has clearly built a robust social security system in the Central Provident Fund (CPF), which is the primary retirement vehicle for most Singaporeans. “The lack of tax-approved group corporate retirement plans and retirement savings for non-residents continues to isolate Singapore from other high graded countries on the global scale.” Mr. Narale explains.

Denmark continued to hold onto the top position in 2014 with an overall score of 82.4. Denmark’s well-funded pension system with its good coverage, high level of assets and contributions, the provision of adequate benefits and a private pension system with developed regulations are the primary reasons for its top spot.

The MMGPI found again there is no perfect system that can be applied universally around the world, but there are many common features that can be shared for better outcomes for individuals. The MMGPI now covers 25 countries and close to 60% of the world’s population. It has grown from 11 countries in 2009 and is the most comprehensive comparison of pension systems globally.

Professor Deborah Ralston, Executive Director of the ACFS said the expansion of the Index reflects the fact most countries are grappling with the social and economic effects of ageing populations and global comparisons can lead to global lessons for government, industry and academia as they debate how best to provide for an ageing population. “Although each country’s retirement income system reflects a unique history, there are some common themes as many countries face similar problems in the decades ahead and the Index aims to highlight the best solutions and share them globally,” said Professor Ralston. “It’s pleasing to note average scores are increasing over time, suggesting pension reform around the world is having a positive effect. The average score for the 14 countries in 2010 was 61.7 compared to 64.3 for the same countries in 2014,” she added.

Good Governance Critical For Success In Changing World

Beyond the Index rankings, the 2014 MMGPI looked at the importance of trust and transparency in a retirement income system.

“The tides of accountability for ensuring financial security in retirement are shifting from State and employer responsibility to individuals in many countries. This trend will continue as life expectancy continues to increase and many governments reduce the per capita expenditure on their aged population. This shift means communication to members has never been more important or come under more scrutiny from members, regulators, employers, consumer groups, politicians and the media,” said Mr. Narale

“Ensuring transparency and the trust of individuals is becoming increasingly important. If you lose community trust in a pension system; you risk losing the effectiveness of the system. “Governments, regulators and financial industries have to ensure good governance frameworks and practices that promote regular easy to understand communication, clear benefit projections, and access to comparative information in a cost-efficient manner. “The pension industry must develop efficient methods to be transparent in meaningful and relevant ways to all stakeholders. There is now no alternative,” he said.