Insights + interviews

6 out of 10 Singaporeans do not have a retirement plan ready

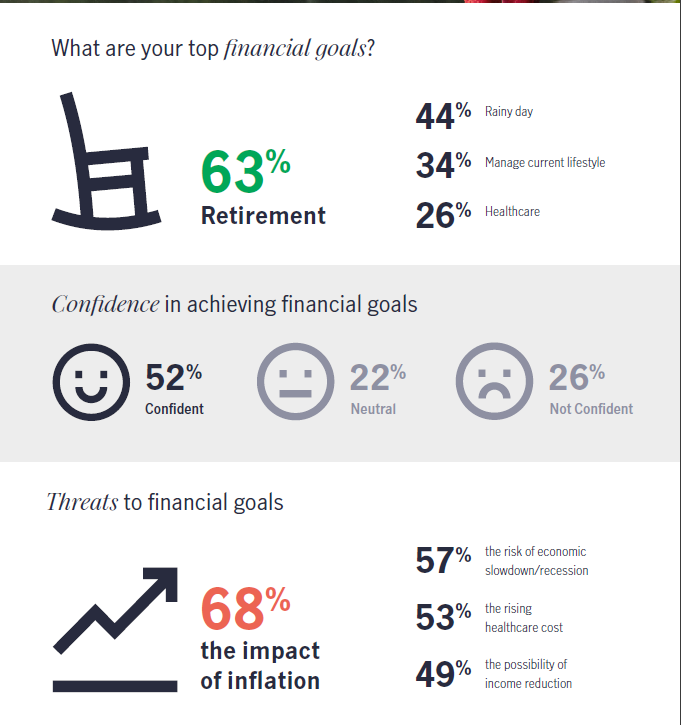

Manulife Asia Care Survey 2023 shows only 35 percent of respondents have a retirement plan; ranging from 25 percent for those in the 25-35 age band to 44 percent of those aged 45 and above.

Singaporeans expect to have a long retirement, starting at the age of 62 years old, with an average lifespan of 83.5 years. This means being able to generate sufficient retirement savings requires planning and, ideally, an early start.

However, the survey found that despite the intention to save, the challenge of accommodating more immediate life priorities in their financial planning means they may struggle to afford a continuation of their existing lifestyle once they retire, and have no other source of income.

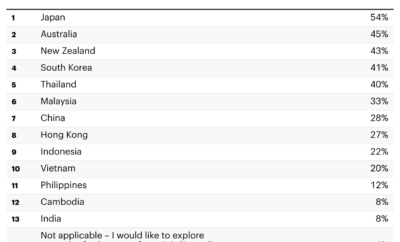

The Manulife Asia Care Survey 2023 shares that nearly two-thirds (63 percent) of Singapore respondents view saving for retirement as their number one personal finance goal, more than anywhere else in the region (average 49 percent).

Despite retirement saving being their top personal finance goal, only 35 percent have a retirement plan in place. This means 3 in 5 (65 percent) respondents still need to put a retirement plan in place when surveyed. Within the retirement plan, only 26 percent indicated they will set aside funds for retirement.

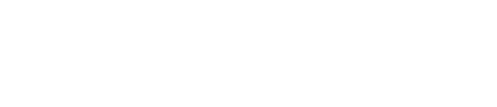

A reason for this observation could be the other financial priorities Singapore respondents have to contend with. Through the survey, they shared that saving for a rainy day (44 percent), maintaining their current lifestyle (34 percent), and medical needs (26 percent) are also important to them, besides retirement saving.

For younger Singapore respondents without children, saving to buy a home is a priority (46 percent), well above the country’s average (21 percent).

Inflation, the risks of economic slowdown and rising healthcare costs are factors contributing to respondents not being confident about achieving their financial goals. 52 percent of respondent shared they are confident of saving for a rainy day and maintaining their current lifestyles (51 percent), but less than half are confident about saving fully for retirement (43 percent), purchasing a home (42 percent) or for their medical needs (41 percent).

Rising healthcare costs are also a major concern in Singapore. 53 percent of the respondents believe healthcare costs pose a risk to their financial goals, more than 10 percentage points higher than the region (42 percent).

Respondents are not passive about managing their own health. The three main actions taken to manage health are exercising more (65 percent), eating a healthier diet (60 percent) and self-monitoring their health (52 percent).

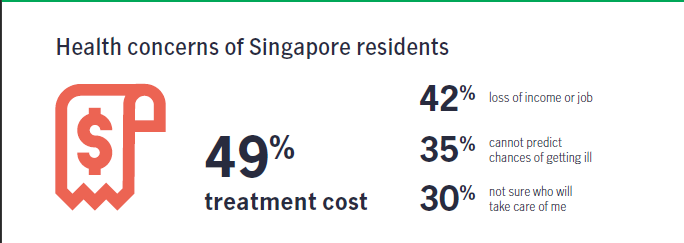

Despite these efforts, most Singapore respondents (94 percent) said they feel anxious or frustrated in managing their health. Their main concerns centre around money – the potential cost of treatment (49 percent) and potential loss of income or job (42 percent).

Most of the respondents in Singapore recognise the importance of saving for retirement, but their other financial needs can get in the way, reflecting the priorities they have to juggle. But it’s a worry that so few have a retirement plan. Retirement planning must start early so that you have a longer runway to grow your retirement funds. While there are many urgencies in life, it is important to prioritise retirement planning so that you are able to enjoy your golden years, when it comes.

Dr. Khoo Kah Siang, Chief Executive Officer, Manulife Singapore

Images and data credit to Manulife Singapore.